What is TRID?

TILA-RESPA Integrated Disclosure rule implementation

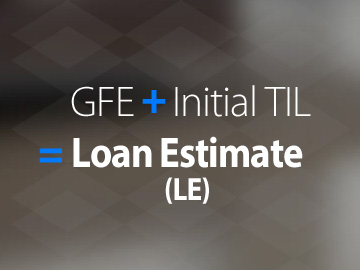

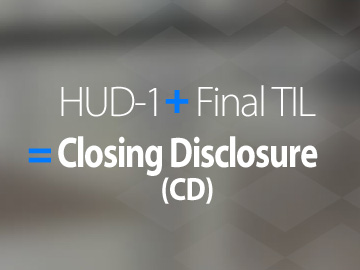

The new Loan Estimate and Closing Disclosure requirements will combine two existing disclosure regimes under TILA and RESPA and make mortgage disclosure easier for consumers to understand and use.

A plain-language guide to the new rules in a FAQ format which makes the content more accessible.

Provides detailed, illustrated instructions on completing the Loan Estimate and Closing Disclosure.

An overview of the limited circumstances when changes to the loan require a new three-day review.

Illustrates the process and timing of disclosures for a sample real estate purchase transaction.

Guide to Completing the Loan Estimate

We’d like to share a common mistakes we have seen on Loan Estimate to help you make adjustments to avoid delay in loan submission.

- Required Document for Submission

- Loan Estimate

- Written Settlement Service Provider List

- Estimate Settlement Statement

- Intent to Proceed, Consent to Receive Communications Electronically

- Submission Checklist

- TRID Timeline

TRID Recorded Webinar

Use these resources to help you and your team prepare for the upcoming changes. We've made it easy to educate your real estate partners with our sponsored Readiness Roadmap Webinar and downloadable presentation materials.

Integrated loan disclosure forms & samples

These are downloadable versions of the models and samples that were published in the rule. Downloadable Loan Estimate and Closing Disclosure forms and samples for different loan types.

- Blank model loan estimate fields annotated to show rule citations

- Blank model loan estimate form that illustrates the application of the rule’s content requirements ( en Español)

- Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller ( en Español)

- Sample of completed loan estimate for fixed rate loan

- Sample of completed loan estimate for interest only, adjustable rate loan ( en Español)

- Sample of completed loan estimate for refinance ( en Español)

- Sample of completed loan estimate for balloon payment ( en Español)

- Sample of completed loan estimate for negative amortization ( en Español)

- Blank closing disclosure with fields annotated to show rule citations

- Blank closing disclosure that illustrates the application of the rule’s content requirements ( en Español)

- Blank closing disclosure that illustrates the alternative disclosures and modifications permitted for transactions without a seller ( en Español)

- Blank closing disclosure that illustrates disclosure provided to seller

- Blank page 2 of closing disclosure that illustrates modifications to closing cost details

- Sample of a completed closing disclosure for fixed rate loan (companion to sample loan estimate above) ( en Español)

- Sample of a completed closing disclosure for refinance (companion to sample loan estimate above) ( en Español)

- Sample of the completed closing disclosure for refinance transaction where the closing costs have increased in excess of the good faith requirements

- Sample of a completed closing disclosure for refinance in which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction

- Sample page 3 of closing disclosure (summaries of transactions) for disclosure of consumer funds from a simultaneous second-lien credit transaction

- Sample page 3 of closing disclosure (summaries of transactions) for disclosure of funds paid outside of closing

- Blank model form for the written list of settlement service providers

- Sample of written list of providers you can shop for

- Sample of written list of providers you cannot shop for

- Blank model form of the escrow cancellation notice

- New consumer guide replaces settlement cost booklet - Your Home Loan Toolkit

Outlook Live Webinar

The CFPB anticipates a substantial volume of compliance and interpretive questions during implementation and plans to use these webinars to consolidate and address these questions in a way that promotes consistent understanding of the rules and provides a resource that stakeholders may reference.