Product Matrix

Click below for details on our complete agency, jumbo and portfolio program guidelines.

Rates

Our company continues to strive to offer our clients competitive interest rates.

Pricing Engine

Try our Product Finder to find the best program and rate that fits your client's need.

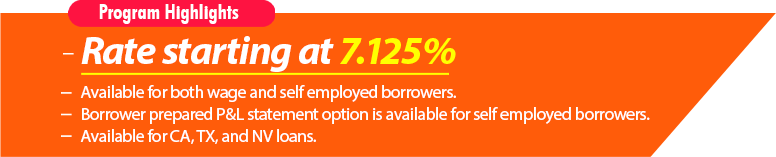

Feature Products

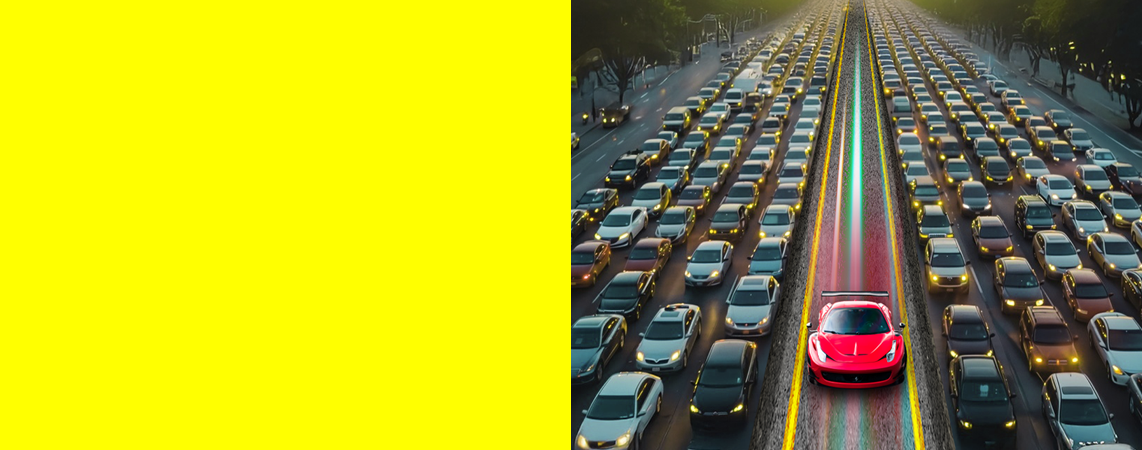

NMSI has a wide array of loan options to fit virtually every need Including;

conforming loan, conforming high balance, Refi Plus, jumbo, and portfolio programs. Please contact your Account Executive for details on how to place your borrowers

into programs and take a look at our program guidelines.

Turn Times

| 03/09/2026 | Purchase | Refinance |

|---|---|---|

Submission |

||

| Registered before 3 pm pst | same day | same day |

| Registered after 3 pm pst | 24 hours | 24 hours |

Underwriting |

||

| Agency | 24 hours | 24 hours |

| FHA | 24 hours | 24 hours |

| KVOE | 24 hours | 24 hours |

| Jumbo Prime | 24 hours | 24 hours |

| HELOC (Initial Review) | 24 hours | 24 hours |

| Multiple REO file | 24 hours | 24 hours |

| Non-QM | 24 hours | 24 hours |

UW Conditions Review |

24 hours | 24-48 hours |

Loan Doc |

24-48 hours | 24-48 hours |

Docs Review |

24 hours | 24 hours |

Funding Conditions |

24 hours | 24 hours |

| Turn times are based on lock date & date of last upload | ||

How to do business with NMSI

Our Services

-

Pricing Engine

Try to find the best program and rate that fits your client's need.

-

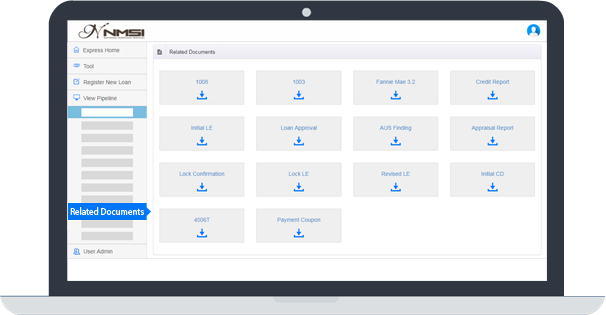

NMSI Mobile App

Our NMSI mobile makes your loan processing easier and faster!

-

e-Disclosures

Quick & Simple. Send initial disclosures and get e-signatures via Npress.

Become a NMSI Broker

It's easy with NMSI. Start today!

Please download Broker Package and/or Non Delegated Correspondent Package. Once you complete the application,

please send it back to your Account Executive.

Our Credit Reporting Agencies

We here at NMSI Inc are please to announce that we continue to add more Credit Reporting Agencies (CRA) to accommodate our clients.

We are now able to accept and reissue Credit Reports from the following List:

CONTACT US

Find contact information for our offices and account executives.

OFFICES

2975 Wilshire Blvd. Ste. 600, Los Angeles, CA 90010

120 S State College Blvd. Ste. 250, Brea, CA 92821

Learn more

Account Executives

If you have a question for your loans,

Contact Account Executives

in your area.

Learn more

EMAIL NOW

Please get in touch with us

by filling out this contact form

and we will contact you as soon as possible.

Learn more